They didn't join us for today's webcast on Massachusetts sales and use tax requirements as a relates to the construction industry my name is Jeff Rogers I'm a tax partner in the construction group at feeling Driscoll a boston-based Regional County firm feelin just goes over 40 years of experience helping clients grow in their businesses if you wish to contact us after the webcast please call us at 888 eight seven five nine seven seven zero or visit us on the web at WWF DC PA calm today we're going to talk about the massachusetts sales and use tax requirements as it relates to the construction industry first a general overview of the sales and use tax law of massachusetts massachusetts imposes a 6.25% sales tax on the sales price or rental charges of tangible personal property sold or rented in the Commonwealth tanjo personal property is the key term their tangible personal property is more or less proper that you can pick up and move whereas when we talk about real property we think of property as generally immovable like land buildings and permanently affixed equipment the buyer pays the sales tax to the vendor at the time of purchase then the vendor remits the tax to the Commonwealth this is pretty straightforward there's no tax the massachusetts imposes and it is called the use tax the use tax is imposed on the storage use or other consumption in the commonwealth of tangible personal property purchased from any vendor or manufacturer fabricated or assembled for materials acquired within or outside the Commonwealth the same six point two five percent tax rate applies now just to be clear this is a counterpart to the sales tax it is not a double tax with the use tax what they are...

Award-winning PDF software

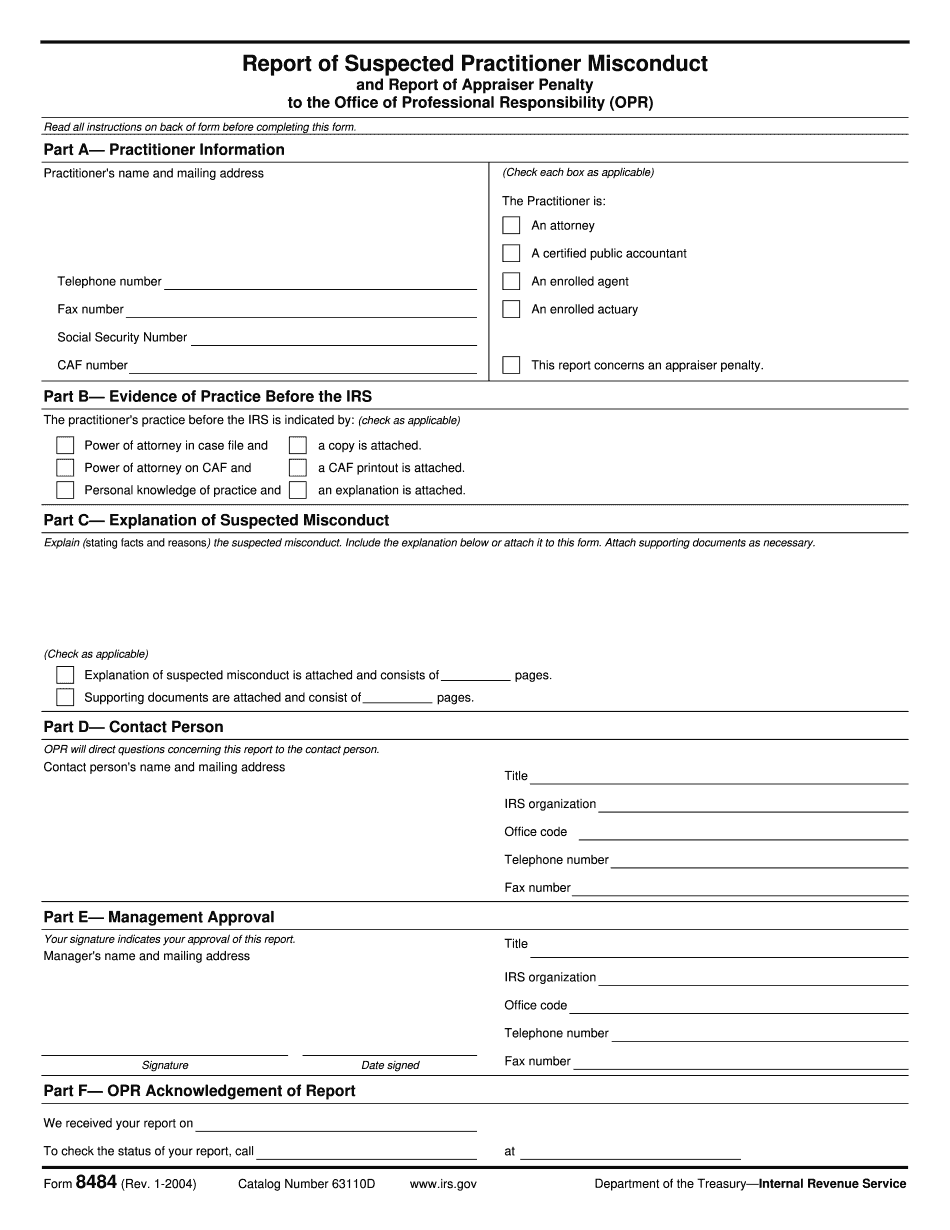

Circular 230 2024 Form: What You Should Know

C.1) Registration with the Taxpayer Advocate Service (TAS). An enrolled agent, enrolled retirement plan agent, or certified public accountant must sign up with the Taxpayer Advocate Service (TAS). c.2) Certification by the Taxpayer Advocate Service. An enrolled agent, enrolled retirement plan agent, or certified public accountant must be certified by, and be recognized as the member of, the TAS by a Taxpayer Advocate if he or she c.2.a) is engaged in a matter that is within the authority of the Taxpayer Advocate Services. c.2.b) has demonstrated that he or she is qualified by training, education, and experience to fulfill the requirements of an enrolled agent or enrolled retirement plan c.3) TAS member qualifications. An enrolled agent, enrolled retirement plan agent, or certified public accountant who is also a member of the Taxpayer Advocate's Section of the TAS provides c.3.a) the following: (i) the IRS has certified the agent or accountant as meeting his or her qualification standards, and the agent or accountant has a high regard for the authority of the TAS and the Treasury Department (iii) has at least ten years of tax experience. c.3.b) The student has successfully completed all tax and ethics training offered by the Taxpayer Advocate Service. c.4) IRS training. An enrolled agent, enrolled retirement plan agent, or certified public accountant who is also a member of the TAS provides c.4.a) the following training to a student after the student is accepted as an enrolled agent, enrolled retirement plan agent, or certified c.4.b) the following training to a student after the student is accepted as an enrolled retirement plan agent or certified c.4.c) The student was enrolled in an online course of training from an IRS organization and completed all training coursework on the c.4.d) training. c.5) Examination.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8484, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8484 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8484 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8484 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Circular 230 2024