Why hire a sax pro to do your taxes when you can use software online to do it yourself? - Here are some questions to consider when trying to decide if you want to hire a tax professional or use tax software. - How much are you willing to spend? The average fee for a tax professional to complete the typical 1040 tax return was around $270. - So how much time do you have? Personal tax software can cost less than a hundred dollars and if your gross income is less than $64,000, you can use tax software from the IRS and file for free. - If you're a single filer who rents an apartment with little-to-no investments, tax software saves you a lot of time. - If you're a married couple with kids looking to itemize deductions, most software includes a quick step-by-step tutorial as well. - If you're a business owner, have bought a home, or you've inherited properties, hiring a tax professional may be the better choice. - Most tax software doesn't provide in-depth explanation on your tax plans, and a tax advisor can offer insight into tax law changes and tax breaks. - How liable do you want to be? By signing your tax returns, the IRS will hold you directly responsible for all the information. - If you hire a tax professional, you can direct all questions to your tax preparer. - You can also give certain kinds of tax preparers, such as enrolled agents, certified public accountants, and attorneys, power of attorney to represent you before the IRS. - Music.

Award-winning PDF software

Irs tax professional Form: What You Should Know

You can either enter your name on the application or give the clerk a copy to use. You will need to bring the appropriate fee and ID to the Weld County Clerk and Recorder's office. Civil Divorces — CO Wedding License Forms, Colorado Please submit all your paperwork and all applicable fees. Civil Unions, CO Recording Office Hours — City of Greeley & City of Centennial For City of Greeley, call the Greeley Clerk's Office at, Monday-Friday except for holidays; and to request duplicate copies of our marriage licenses, call. For City of Centennial, call, Monday-Friday except for holidays. (There are no weekday service hours, Saturday, Sunday.) Recording Office Hours — City of Latimer Call the Latimer Clerk's Office at, Monday-Friday, 9:30am-5pm, Saturday, 10AM-3PM. Recording Office Hours — City of Broomfield Call the Broomfield Clerk's Office at, Monday, Tuesday, 9:30am-5pm and Thursday and Friday, 9:30am-5pm. Recording Office Hours — City of Pueblo Call the Pueblo Clerk's Office at, Monday-Friday 9:30am-5pm. Recording Office Hours — City of Durango Call the Durango Clerk's Office at, Monday-Friday 9:30am-5pm. Recording Office Hours — City of View Call the View Clerk's Office at, Monday-Friday 9:30am-5pm. Recording Office Hours — City of Longmont Call the Longmont Clerk's Office at 303.414.4263, Monday-Friday 9:30am-5pm. Recording Office Hours — City of Fort Collins Call the Fort Collins Clerk's Office at 671.912.6200, Monday-Friday 9am-5pm. The next available recording schedule is Tuesday-Saturday/Friday 9:30am-5pm.

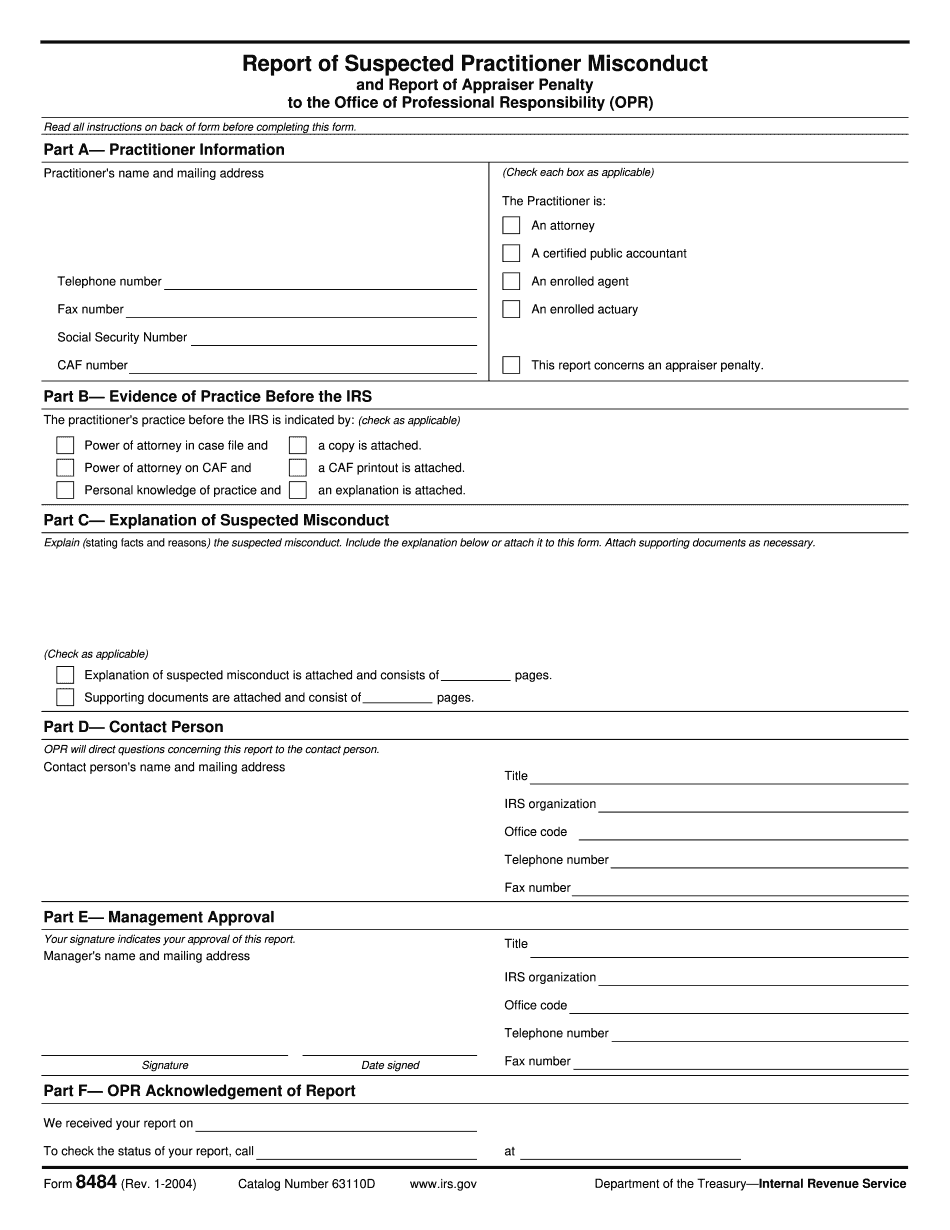

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8484, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8484 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8484 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8484 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs tax professional