Hi, I'm Joe Mass Triano CPA. After 25 years and thousands of tax cases, I know the IRS business like the back of my hand. If you have any tax issues with the IRS, we will personally call them, pull your records, prepare your tax returns, file appeals - whatever it takes to solve your IRS problem. You can put my many years of successful IRS experience and excellent reputation to work for you. Why pay more for less? Contact me right now. You'd be surprised at what I can personally do for you.

Award-winning PDF software

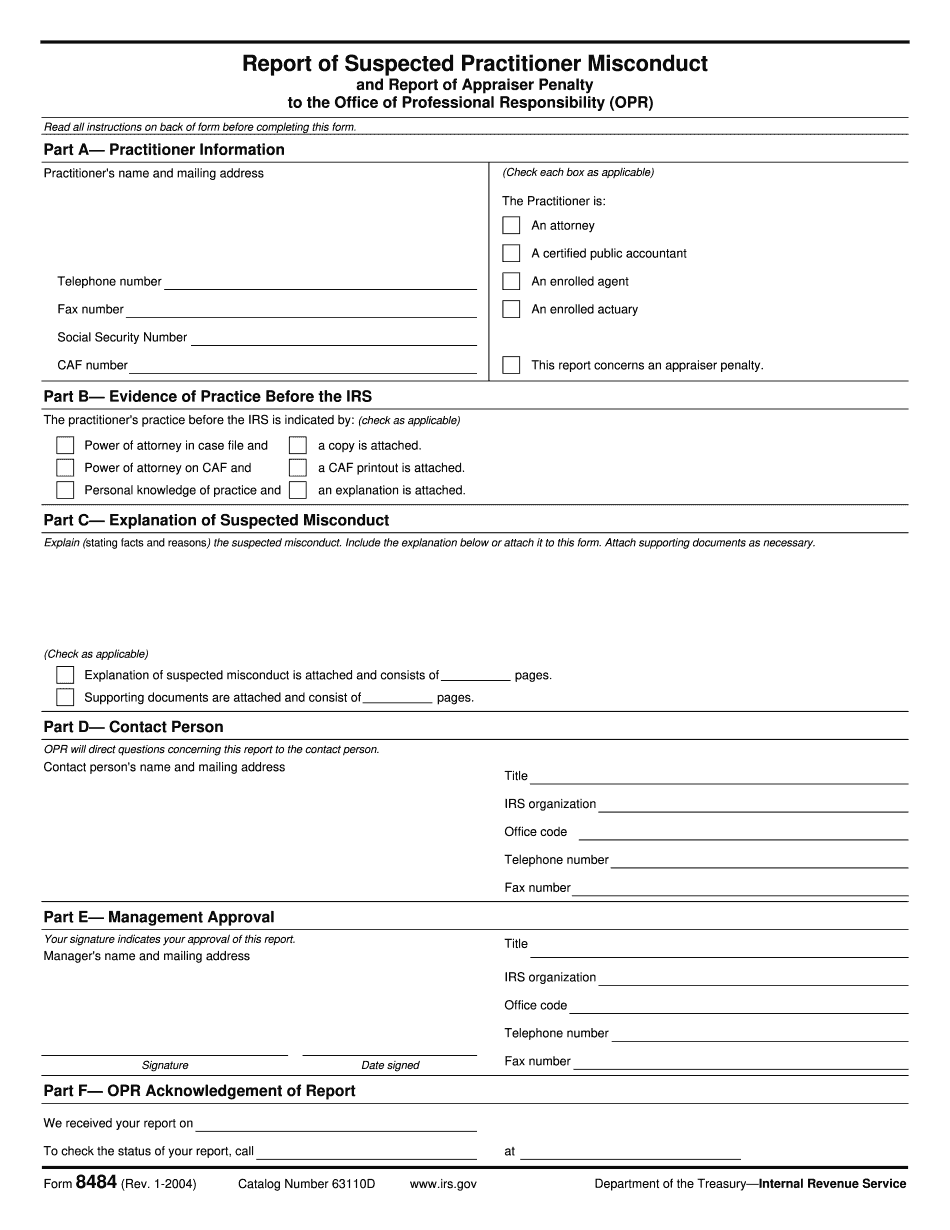

Irs letters to tax preparers Form: What You Should Know

Information Sheet for Income and Gains Tax (IRC Section 7429(a) (3)) — IRS Sep 28, 2024 — See the IRS information sheet for IRC Section 7429(a) (3) for information regarding the due diligence requirements for taxpayers who prepared tax-free status adjustments for an extension ▷ To be completed by preparer and filed with Form 1040, 1040-SR, 1040-NR, 1040-PR, or 1040-SS ▷ Go to for instructions and the latest Internal Revenue Service (IRS) information on how to complete Form 42480, Due Diligence Statement, to be completed by taxpayer. Sep 21, 2024 — Letter from the IRS notifying taxpayers of new, effective January 1, 2024 (effective January 1, 2019, for taxpayers who plan on filing a joint return by filing a joint Form 1040). This letter also explains the additional Note: The text of the Letter is below: Notice to Individuals of New Tax Rules (Effective January 1, 2024 (Effective January 1, 2019, for those who plan on filing a joint return or Form 1040). We are updating the requirements that apply to individuals who plan to file a joint return on the new tax rules. The new tax rules apply to filing a joint return on or after January 1, 2025. Notice 2018-07, May 10, 2018, Effective January 1, 2018, Form 1040, Estimated Income Tax Return, and Form 1040A, Amended Federal Income Tax Return, will no longer be accepted by IRS to report income from passive activities of individual taxpayers other than S corporations. S corporations are discussed in the instructions for Forms 1040 and 1040A. A. Individuals who file a joint return for tax purposes on or after January 1, 2018, will no longer be able to use the following deductions to figure their adjusted gross income (AGI): · Standard deduction. · Additional standard deduction. · Loss carry forward. C. Individuals who file a joint return for tax purposes on or after January 1, 2018, must include in income as taxable income all passive activities of the taxpayer except passive activities carried on by the taxpayer as an S corporation for Federal tax purposes.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8484, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8484 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8484 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8484 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs letters to tax preparers