Okay, well, we're live now. My name is Gary Leroy. I'm the principal for Taxpro Easy. I've been an educator for adult studies for the last two decades and teach mainly at the graduate and undergraduate level. Several years ago, I began teaching tax courses and we held several boot camps last year that proved to be very beneficial for our students. This year, we're proud to partner with Climb. You'll notice my logo and Climb's logo in the lower right-hand corner. As I mentioned earlier to some people who were on the air earlier, we've partnered with Climb for a number of reasons. First of all, they take an educational approach to the content they're presenting. The second thing is their technology is far superior to anyone else's technology that I've been able to observe. You're going to see a little bit more of that as we go in, as Alexander Graham, who has joined us with Climb, comes in and guides us through Climb Talk and Climb U, which is the portal we use for our online EI boot camps. The other thing that really attracted me to Climb was their flexibility because not everyone needs help in all three parts of the enrolled agent exam. So, we have the flexibility to offer it on a part-by-part basis. You'll see that as we go through this material and talk about it a little bit more. So, let's go ahead and get started. We're looking at your pathway to the enrolled agent license. The enrolled agent is a very unique endorsement, a very unique licensing approach. There are some new practice restrictions that went into play on January 1st of this year. To be an enrolled agent, you need to be an unenrolled preparer who has a record of completion for the tax...

Award-winning PDF software

Circular 230 2024 Form: What You Should Know

CPA before the Department of Treasury. In this case it's a hybrid of Tax-CPA Articles — AICPA CPA Article 12— IRS Circular 230 Tax-CPA Articles — AICPA If you are unsure, it's advisable that you contact a qualified, expert, tax adviser who would know more about that specific part of these documents. [2] Notice 2007-41, Revenue Procedure 2007-20, effective Aug. 1, 2007, requires that all CPA, CPA-S, and CPA-L certificate holders, including foreign CPA, CPA-S and CPA-L holders, are prohibited from communicating, or attempting to communicate, with taxpayers or their representatives. It is the responsibility of the affected taxpayers and their Representatives to immediately communicate about the IRS's concerns about IRS tax compliance problems to the Department of Treasury (T) Office of the Deputy Commissioner for Services and Enforcement (ONE), and IRS will not attempt to communicate any communications to the taxpayer. (See IR‐60.17) [2] Treasury Regulation 201.6010 establishes the OGE as the “functional head of the IRS's internal auditor group.” Treasury Regulation 201.60200 sets out procedures for the “Responsibilities of Internal Auditors.” [3] Treasury Regulations 201.6010 and 201.60200 are at Internal Revenue Manuals § 9.2(p)(1) and § 8.

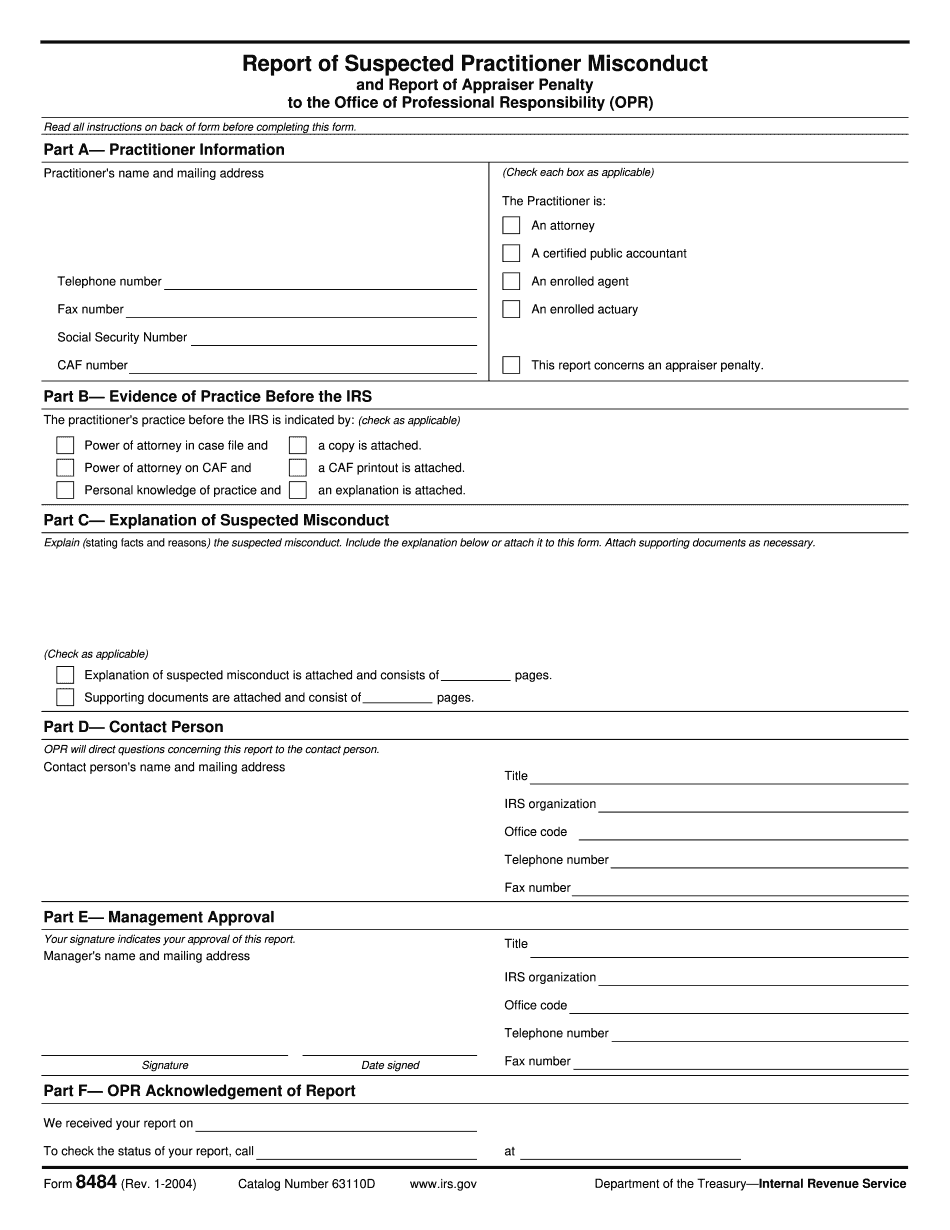

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8484, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8484 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8484 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8484 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Circular 230 2024