Award-winning PDF software

Most recent circular 230 Form: What You Should Know

Making deductions of tax under the Code, claiming deductions, claiming income tax credits etc. • administering and administering the Code, Form 1040. • providing advice to the client (like tax attorneys) • serving as tax advisors to an individual or a partnership. • preparing tax statements, reports and information returns for the client. • handling a client's return (Form 1040) or correspondence (e.g., Tax Forms W-2A, 1099 and other correspondence). • preparing IRS-related tax documents such as Forms 30 and 7, Form 3949(S)(1) and Form 6251. • assisting in preparation of the client's returns (e.g., Form W-2), tax statements and other correspondence for the client. • determining whether the information contained in the returns, statements and correspondence of the client, was correct. • establishing the validity of the client's tax returns, statements or correspondence. • advising the clients (or in some cases the client's attorney) of a change of circumstances with respect to the client, and of possible actions, if any, that ought to be taken. The CPA must also prepare an audit or other response to an IRS audit or other requests for information. In accordance with Treasury Regulations, Circular 230 provides the following standards of competence, integrity and conduct for the CPA: “As it relates to tax matters, the CPA's competence is to provide services for the preparation of return by the client. The CPA's integrity is to ensure that all client services are accurate and truthful. The CPA's conduct is to ensure that he/she is honest and tells the truth while engaging in the taxpayer's business, which has been performed. “ “As its essential function, the CPA must be the competent, honest and independent custodian of the client's funds. This function involves providing advice on the tax-relevant matters which are the same as are the routine activities conducted by the taxpayer. For example, the CPA's competence may include the same matters as an attorney who is preparing the tax returns, files, statements or other materials required by the client. The CPA's integrity must include the same competence as an attorney or preparer who assists the client in preparation of a return, filing, statement or other papers required by the taxpayer.

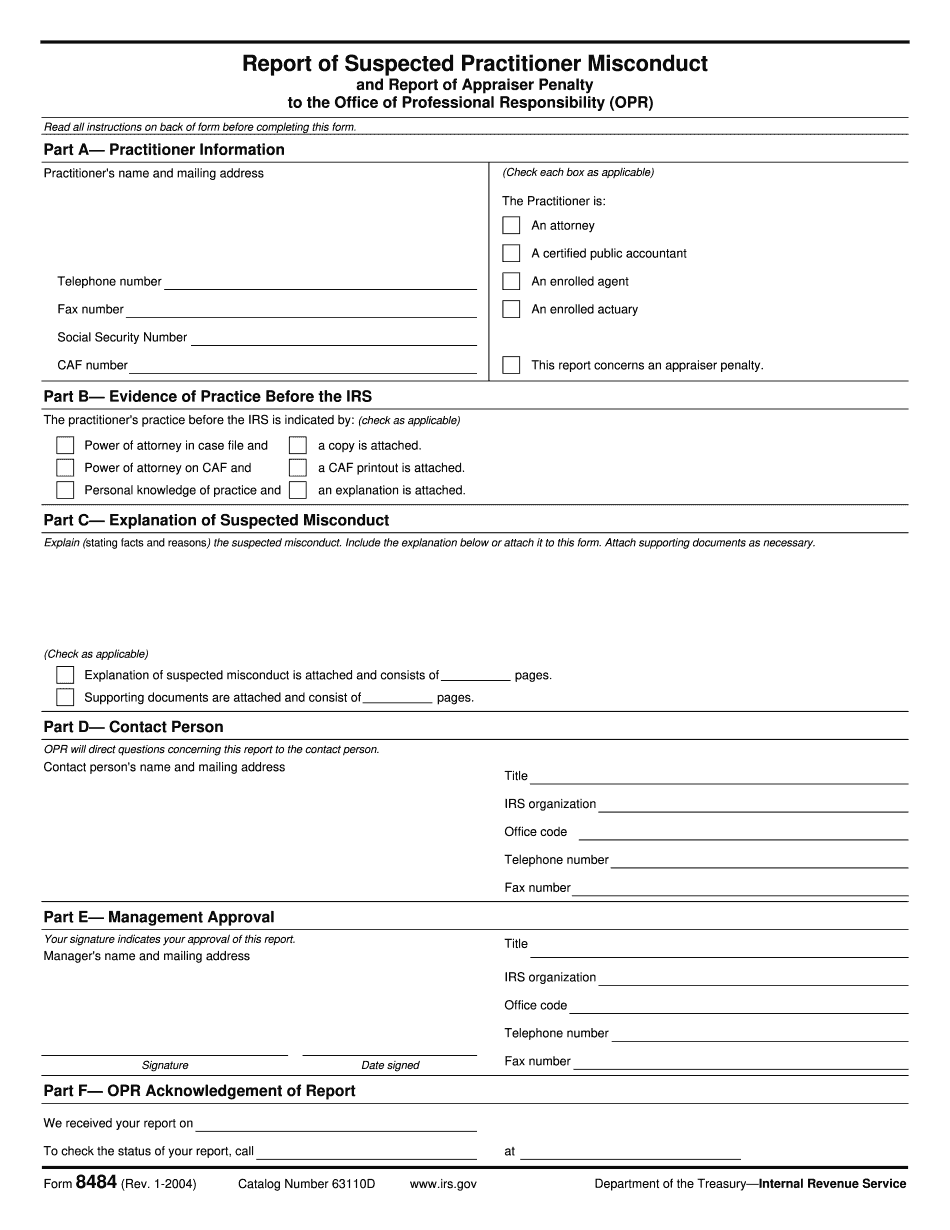

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8484, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8484 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8484 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8484 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.