Award-winning PDF software

Tax preparer responsibilities irs Form: What You Should Know

Understanding Tax Return Preparer Credentials and — IRS Feb 1, 2024 — The Taxpayer Advocate Service (Taxpayer Advocate) provides an independent advocacy role to guide taxpayers and the IRS about their tax affairs, including all matters of credit, tax debt, refund, and refund ability. Understanding Tax Return Preparer Credentials and — IRS Sep 30, 2024 — The IRS releases the “2017 Guide to Taxpayer Rights and Benefits,” providing an overview of the tax law, tax collection, collection allowances, and the IRS Taxpayer Advocate service. Understanding Tax Return Preparer Credentials and — IRS Oct 1, 2024 — IRS releases “2018 Guide to Taxpayer Rights and Benefits,” providing an overview of the tax law, tax collection, collection allowances, and the IRS Taxpayer Advocate service. Internal Revenue Service Sep 8, 2024 — The IRS adopts new “taxpayer advocacy” and “consumer protection” policies that “reduce taxpayer stress” and “reassure taxpayers.” Understanding Tax Return Preparer Credentials and — IRS. Sep 2, 2024 — The IRS creates “Taxpayer Advocate Service (TAS)” to protect taxpayer rights and advocate on behalf of taxpayers; to help the IRS improve its efforts to enforce tax law; to support the IRS's role as a taxpayer advocate; to provide guidance to IRS employees about the IRS' advocacy obligations of the TAS; to serve to “improve the quality and fairness of all public and private programs designed to assist taxpayers.” Understanding Tax Return Preparer Credentials and — IRS Sep 2, 2024 — “An independent, non-profit, 501c3 organization, whose mission is to help Americans fulfill their promise of financial security and financial independence.” Riding the wave of the “Occupy” movement, a Taxpayer Advocate was created for the purpose of assisting taxpayers to protect their tax and constitutional rights. The nonprofit Taxpayer Advocate Service (TAS) was established in 2024 by the Internal Revenue Service (IRS). Tax Professionals “has partnered with the ACLU of Northern California's Freedom of Information Law Project (FOIL) to provide a comprehensive resource guide entitled, Protecting Your Taxpayer Rights: Protecting the Rights of Taxpayers Through Government Advocacy. . .

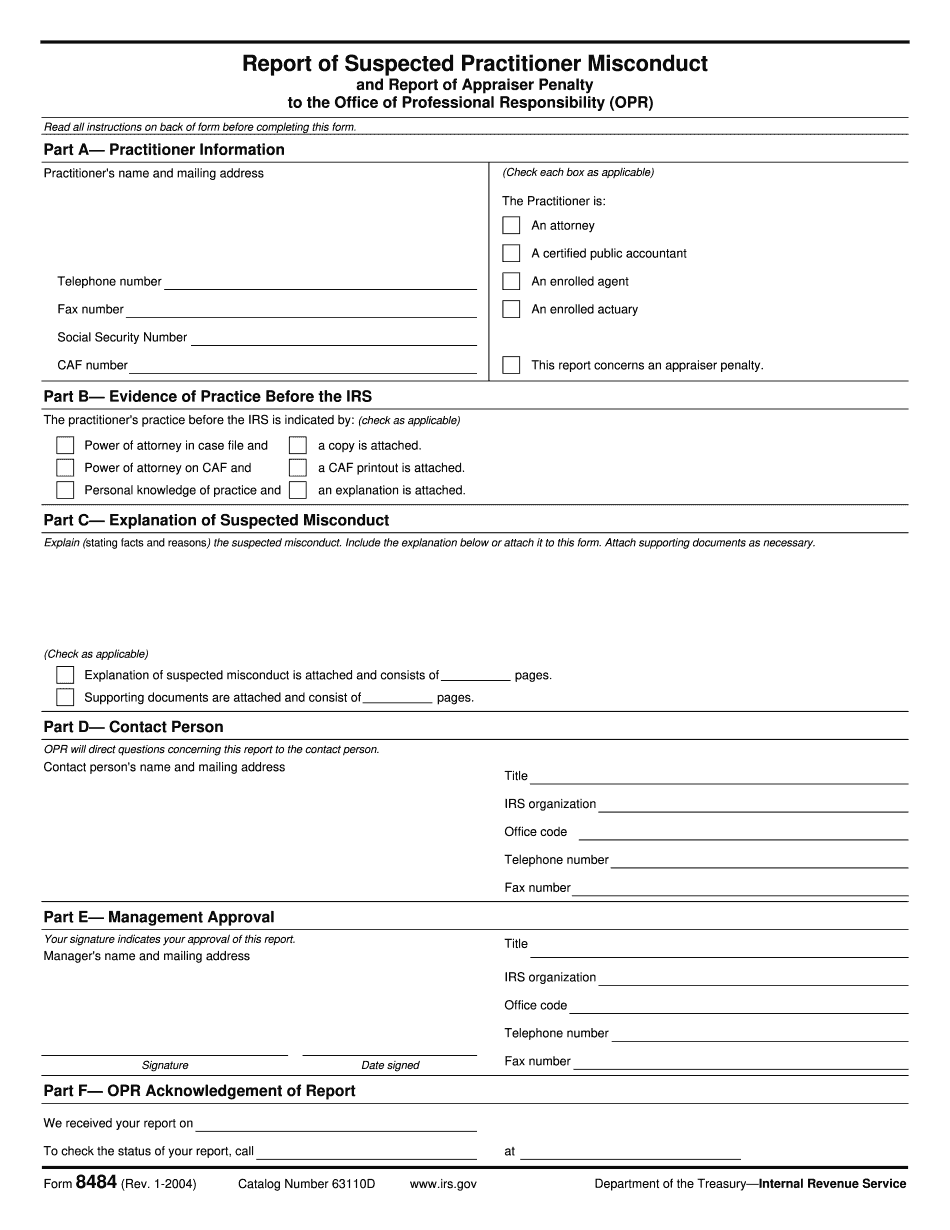

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8484, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8484 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8484 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8484 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.