Now let me start with a baseline question: Ken, what other standards govern the behavior and conduct of tax professionals? Well, there are several standards that do govern behavior and conduct. The IRS has issued circular 230, which outlines their standards. Additionally, the AICPA has their own code of conduct, which applies to CPAs in all practices, including tax. There are also separate standards for tax practitioners, and the state boards of Accountancy govern the CPA license. These boards expect CPAs to adhere to the standards set by the profession, which are determined by the AICPA and the circular 230 of the IRS. It's interesting that you mentioned circular 230, Ken. We have discussed the guidance it provides on this program in the past, mostly in relation to positions taken on income tax returns. To what extent has the IRS expanded and extended the guidance provided by circular 230 in recent years? Last year, the IRS introduced updated standards for circular 230. They were particularly concerned about the nature of practitioners and the practices they engaged in. The IRS aimed to provide more guidance and expand the knowledge and responsibilities of practitioners. Notably, the AICPA goes even further in certain cases. While tax practitioners are a class of preparers, there are also non-CPAs and non-professionals who prepare taxes. The AICPA believes that professionals should adhere to a higher standard. As a result, their code of conduct has expanded to include areas such as fees, conflicts of interest, confidentiality, and overall responsibilities. The expectations placed on CPAs go beyond what the IRS expects from tax preparers.

Award-winning PDF software

Irs circular 230 disclosure Form: What You Should Know

Form 1040SR) IRS Form 1040 is filed by U.S. taxpayers who filed a return for the taxable year ending on or after April 17, April 15, October 15, November 15, or December 15. For tax years ending before 2013, taxpayers use Form 1040EZ. For tax years ending on or after 2013, users of Form 1040 must use Form 1040NR. Form 1040NR is used by those who have not filed a return and paid federal income taxes for any part of the calendar year. Current Revision. Form 1040NRPDF. Instructions for Form 1040NR or Form 1040NR-EZ. Form 1040X. U.S. Individual Income Tax Return for the Year Ending With or Without Dependent Children, the U. S. Individual Income Tax Return for the Year Ending With or Without Dependent Children (Without Children), or the Taxpayer's Amended U.S. Individual Income Tax Return — IRS Annual Form 1040X U.S. Individual Income Tax Return for the Taxpayer's Years With Dependent Children (Without Children), or for Any Taxpayer Who Has Not Filed a U.S. Income Tax Return For All Years, and the Individual Income Tax Return With Refunds and Cancellations For Tax Years Ending After 2024 — IRS Form 1040X PDF. Instruction and supporting documentation for Form 1040X. Form 1040X-NR PDF. Instructions and supporting documentation for Form 1040X-NR. Form 1040X-SR PDF. Instructions and supporting documentation for Form 1040X-SR. IRS Form 1040X for taxpayers who filed Form 1040X for all years, and for any Taxpayer Who Has Not Filed a U.S. Individual Income Tax Return For All Years, and the Individual Income Tax Return With Refunds and Cancellations For Tax Years Ending After 2024 — IRS Form 1040X-NR. Instruction and supporting documentation for Form 1040X-NR. Form 1040X — IRS Form 1040X U.S. Individual Income Tax Return for Tax Year With Dependent Children and Income With Residence Abroad. Form 1040X-NR PDF. Instructions and supporting documentation for Form 1040X-NR. Form 1040X-SR PDF. Instructions and supporting documentation for Form 1040X-SR. Form 1040X-PDF. Instructions and supporting documentation for Form 1040X-PDF.

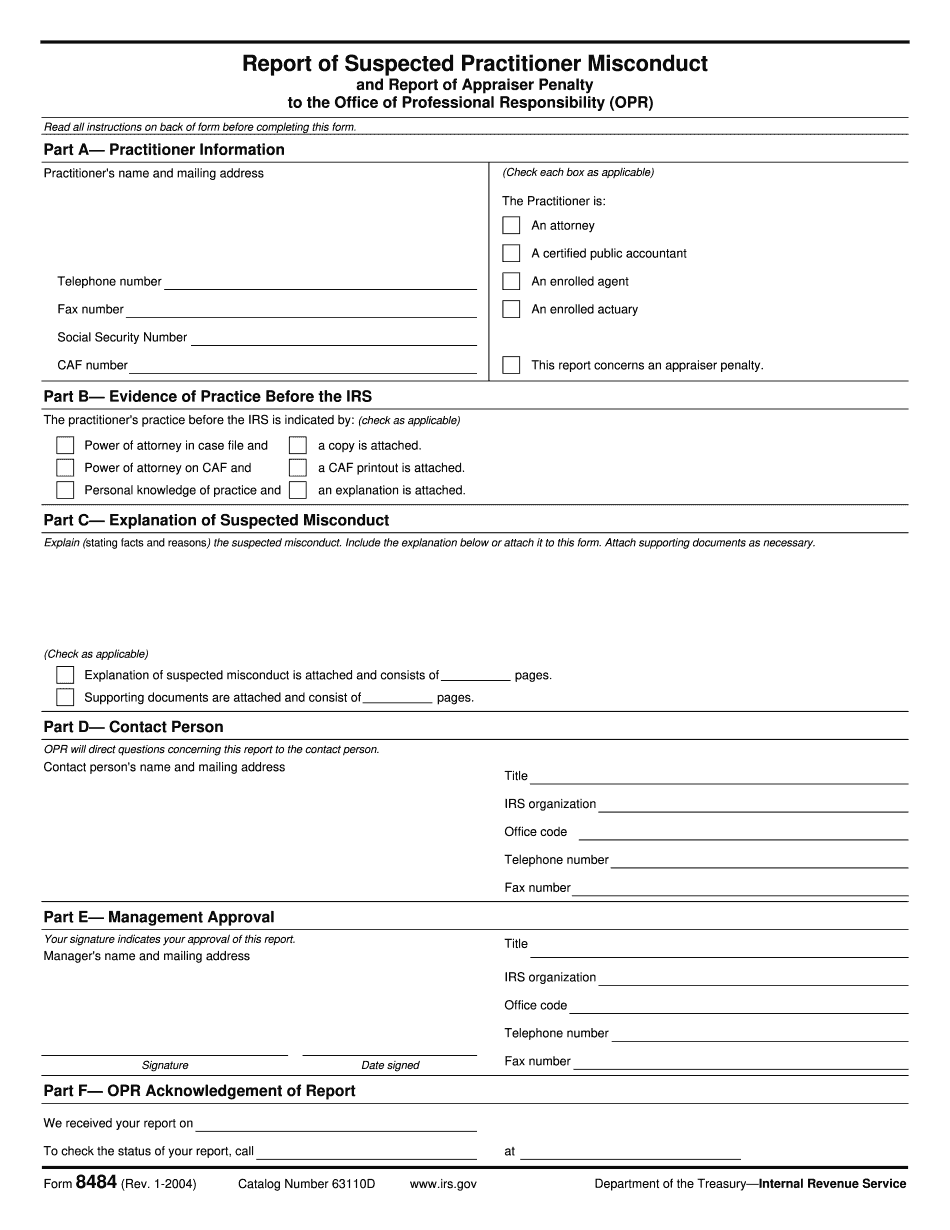

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8484, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8484 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8484 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8484 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs circular 230 disclosure